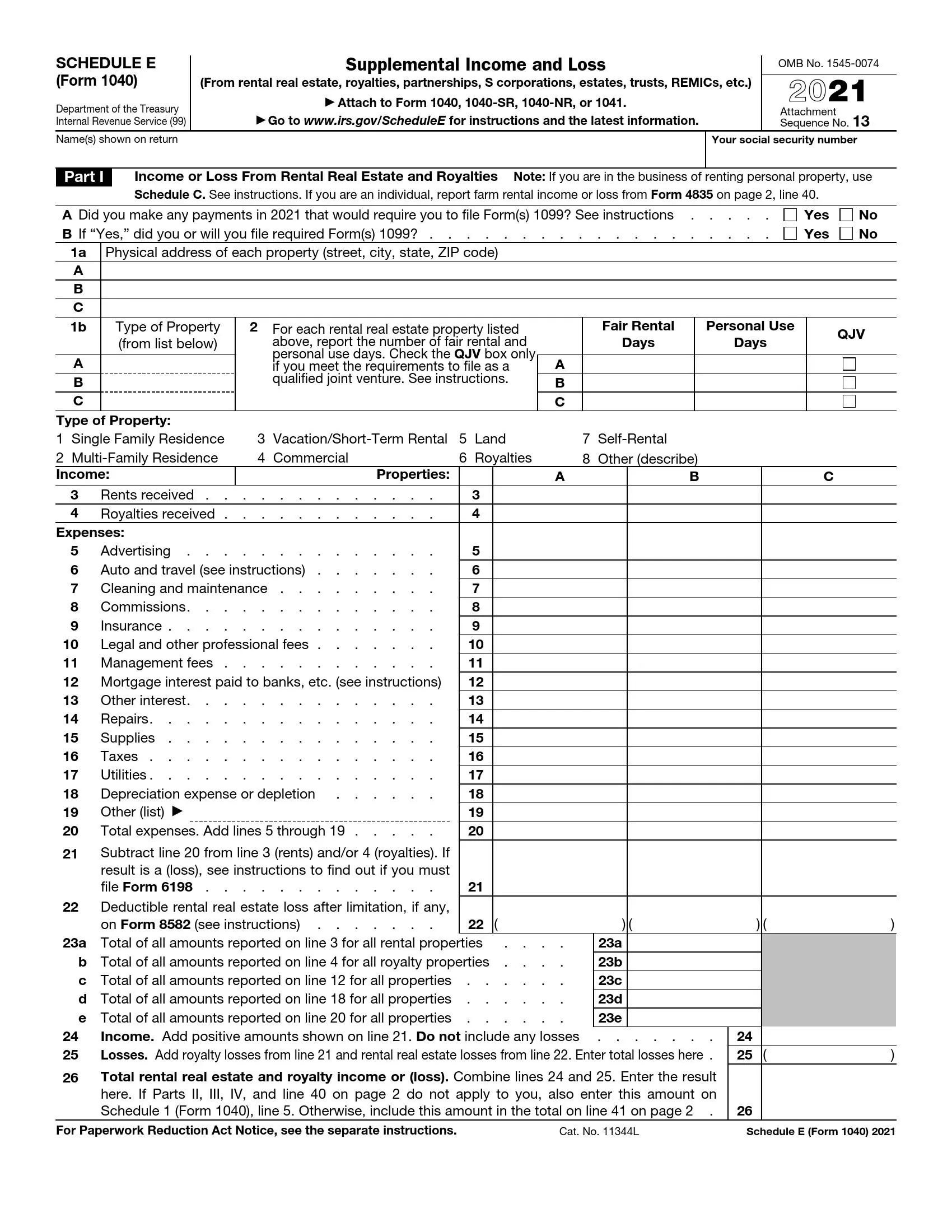

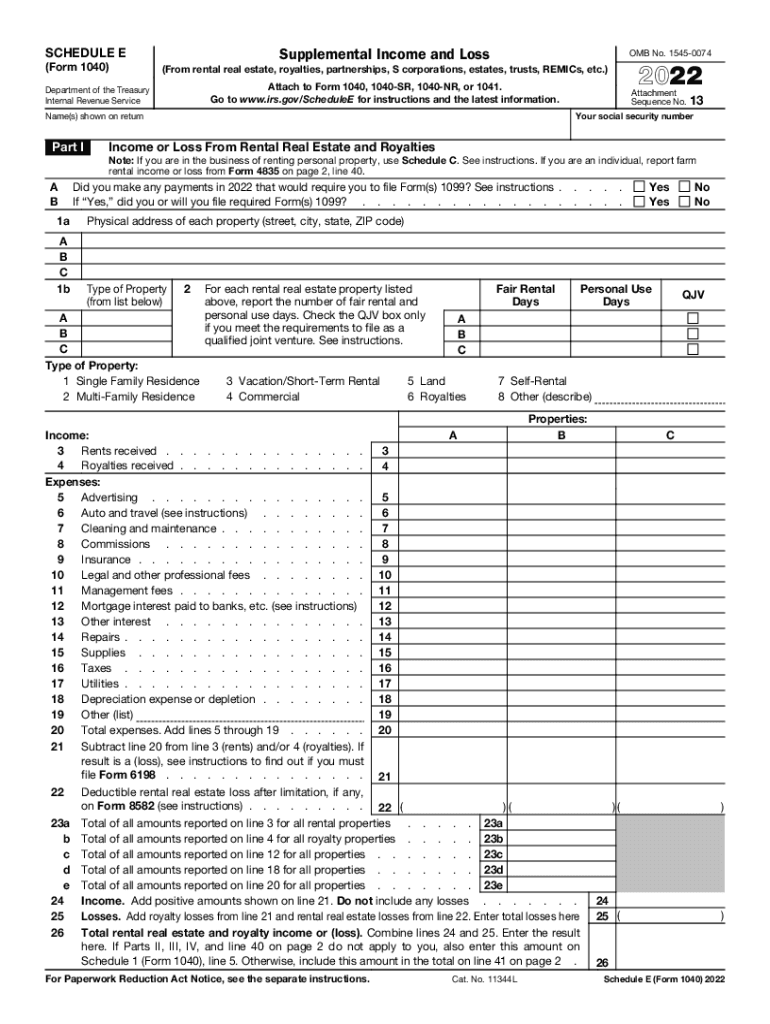

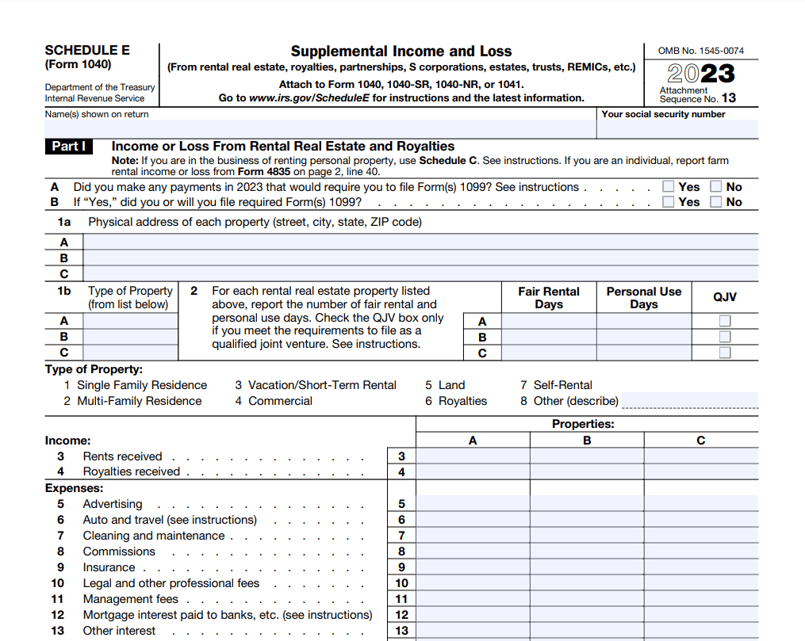

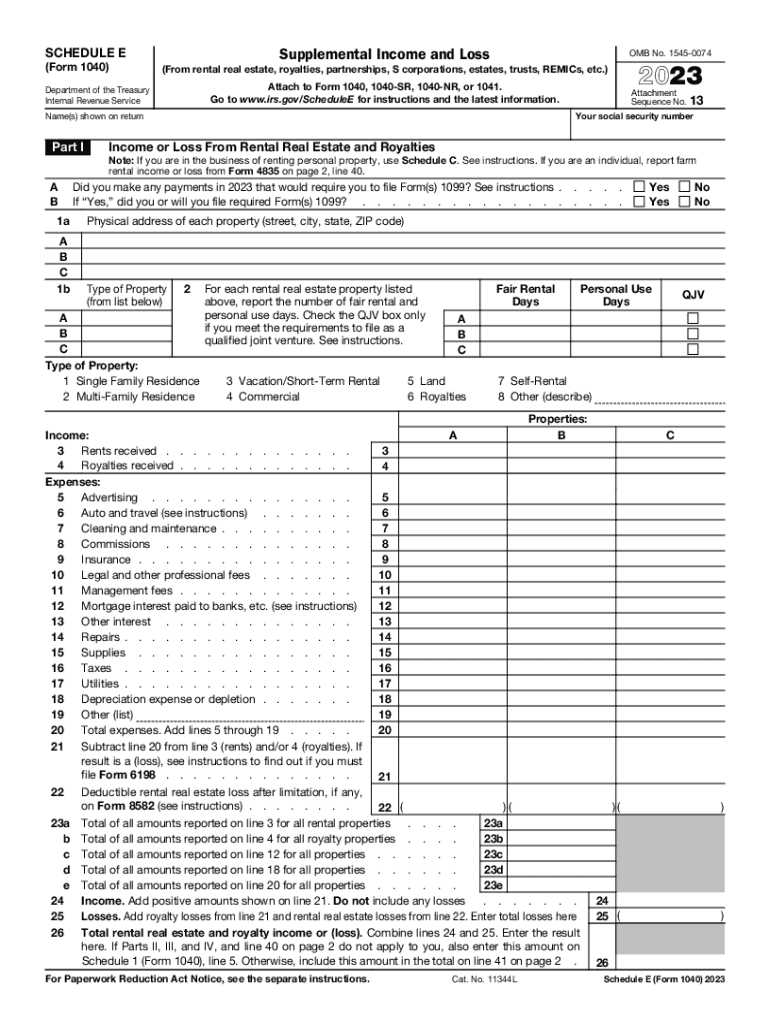

2024 Schedule E Form 1040 Instructions – The Internal Revenue Service requires all income from a rental property to be reported on Form 1040 Schedule E. The same form also allows you to deduct certain expenses related to the rental from . For S Corporations filing Schedule E and Schedule C owners, the deduction takes place on the 1040 tax form. For C corporations, regardless of size of the corporation, the premiums for the employee .

2024 Schedule E Form 1040 Instructions

Source : formspal.comSchedule E Instructions: How to Fill Out Schedule E in 2024?

Source : www.noradarealestate.comTax form schedule e: Fill out & sign online | DocHub

Source : www.dochub.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comE1204 Form 1040 Schedule E Supplemental Income and Loss (Page 1

Source : www.greatland.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.com2023 Form IRS 1040 Schedule E Fill Online, Printable, Fillable

Source : irs-form-schedule-e.pdffiller.com2024 Schedule E Form 1040 Instructions IRS Schedule E Form 1040 ≡ Fill Out Printable PDF Forms: This is reported on Schedule E for an individual’s tax return filed on Form 1040. An S corporation prepares For more on qualifying as an S-corp, see the instructions to Form 2553. . Stay informed about U.S. taxation for the year 2023. Learn about Form 1040, Schedules, filing deadlines, and essential instructions. Ensure a smooth tax season. .

]]>